Subscribe To Our Newsletter

Join our 50,000+ happy customers

[mc4wp_form id=""]

We’ll Design 🎨 Your Card For Free!

Free Next Day 📦 Delivery in UK

We Ship Worldwide 🌎 ✈️

To add an NFC card at first download and open Google Wallet, tap the ‘+ Add to Wallet’, enter your card details, and verify with your bank. Once verified, your phone is ready for secure contactless payments anywhere they’re accepted.

Here in the UK, tapping to pay has become so popular. In fact, over 75% of debit card transactions are now contactless. Google Wallet doesn’t just handle debit or credit cards now. You can also add TfL passes, loyalty cards for your favourite shops, and even student or work IDs when they’re supported. Everything you need lives in one app, reducing paper waste and keeping your details safer.

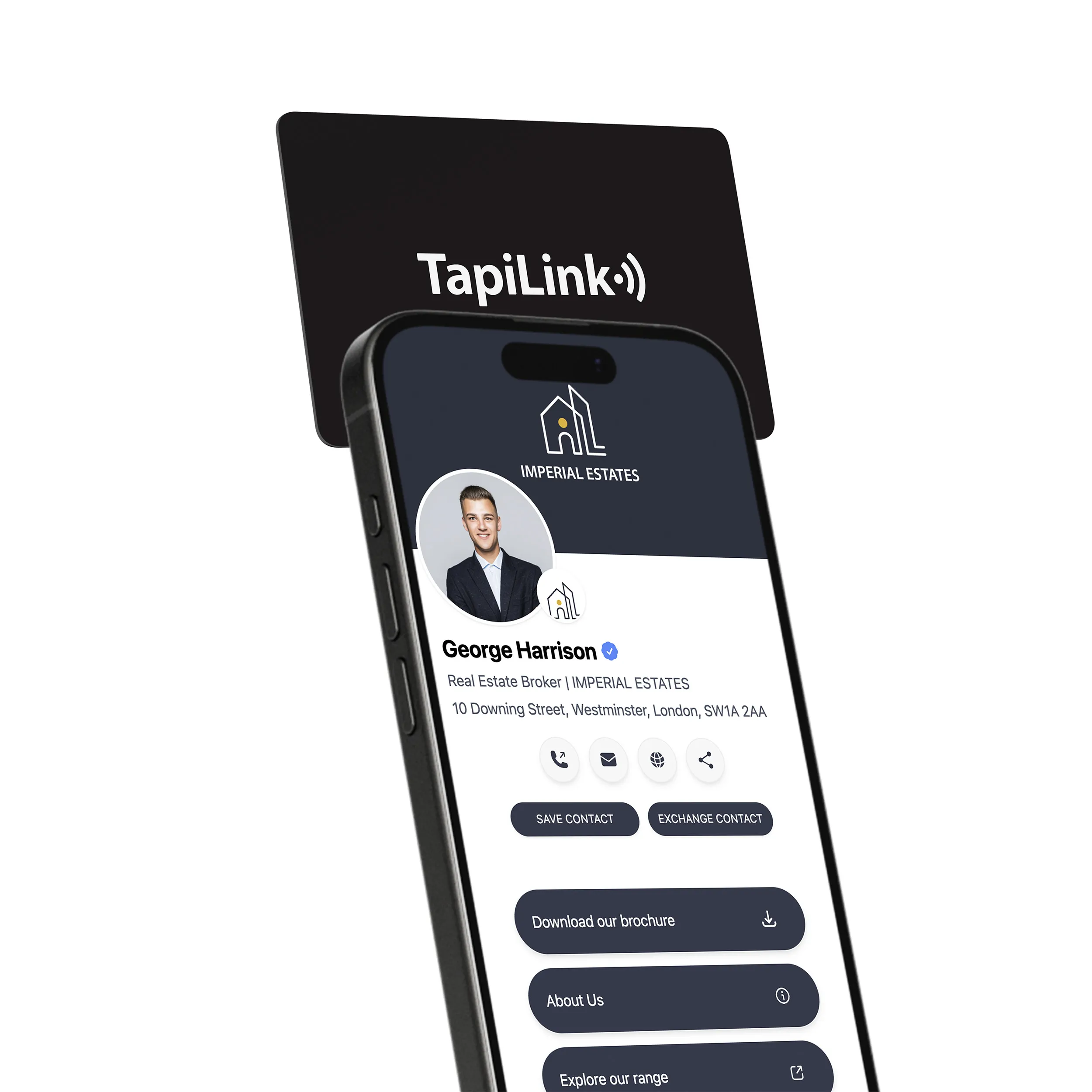

Ditch the stack of plastic cards. With Google Wallet, you move faster, pay safer, and travel lighter. And with TapiLink, you can add a digital NFC business card to your Wallet, making payments and networking possible with just one tap.

An NFC card is a type of smart card that uses Near Field Communication to connect with a reader when it’s held close, usually within 2–4 cm. That short range is intentional: it makes NFC fast and secure, because the card only responds when you’re right by the reader.

The card has a small chip and antenna built in. When you tap it on a payment terminal, ticket barrier, or door scanner, the reader sends out a signal that powers the chip and transfers your data almost instantly.

Why NFC cards are popular:

1. Speed: tap-and-go in less than a second.

2. Security: The short range reduces risks of remote skimming.

3. Convenience: no PIN or swipe needed.

4. Everyday use: from debit cards to TfL gates and office passes.

In short, NFC cards are what make your daily “tap to pay” and “tap to enter” moments possible.

Inside Google Wallet, NFC is used for secure contactless communication. When you tap your phone on a reader, the NFC chip sends encrypted data over a very short distance.

In Google Wallet, NFC is mainly used for:

• Contactless payments (debit and credit cards)

• Transport passes and tickets

• Supported digital IDs and loyalty cardsIt’s important to note that Google Wallet does not create NFC cards. It only stores and uses cards that are already approved and issued by supported providers.

You can add most UK bank cards, including Monzo, HSBC, Lloyds, and Barclays. Once added, your phone becomes a secure contactless card for everyday payments.

In London, you don’t need a separate Oyster. Just tap with your bank card in Wallet for daily fare capping. Some regional operators also support digital tickets.

These aren’t added manually. Your uni or workplace must provide a digital version that you can load into Wallet for entry and services.

Many UK retailers now issue Wallet-ready loyalty cards. Adding them means no more juggling plastic at tills or gym desks.

With services like Tapilink, you can keep a business card in Wallet and share your details in seconds with a simple tap.

Many people ask whether office access cards, apartment door cards, or hotel key cards can be added to Google Wallet. The short answer is: usually no.

Google Wallet only supports NFC cards and passes that are issuer-approved. This means the organisation that issues the card (such as a bank, transport authority, or institution) must have an official integration with Google Wallet.

• Office and door access cards use closed security systems

• Google Wallet does not allow manually adding third-party NFC access cards

• These restrictions exist to protect security and privacy

• Some universities or large organisations provide official digital IDs

• These can only be added through an invitation or a dedicated app, not manually

If your NFC card is used for building or door access, it is very unlikely to be supported by Google Wallet.

Alright, before you can start tapping your phone to pay like magic, let’s make sure it’s set up properly.

1. First, pop into your settings and flick on NFC. That’s the clever bit that lets your phone talk to card machines. Without it, nothing happens.

2. Next, check the Google Wallet app in the Play Store and update it if needed. An old version can be a bit fussy.

3. Then, tell your phone that Google Wallet is your go-to payment app so it’s always ready when you tap.

4. And last but not least, set up a screen lock, whether that’s a PIN, fingerprint, or face unlock. It keeps everything safe and makes Wallet work.

Do those four things, and you’re good to go. No more digging for your bank card at the checkout.

Adding an NFC card to Google Wallet is a bit like setting up your first streaming account. Once you’ve done it, you’ll wonder why you didn’t do it sooner. Let’s go through it step by step, and I’ll give you some tips along the way.

Start by unlocking your phone and opening the Google Wallet app. Don’t see it? No problem. Head to the Google Play Store and download it. It’s free and quick to install.

Alright, app ready? Let’s move on.

On the main screen, tap the “+ Add to Wallet” button. This is where you can add payment cards, passes, tickets, and even digital keys.

That was easy enough. Now for the interesting part.

The app will now ask what type of card you want to add. You’ll usually see options like:

1. Payment card: debit or credit card from your bank.

2. Transport pass: TfL contactless travel or regional bus/train tickets.

3. Loyalty, membership, or business card: supermarket points, gym memberships, or even a digital business card.

Think of this as choosing which tool you need. Each has its own use.

Here’s where you’ll provide the details:

1. For payment cards, either scan your card with the camera or type in the details. Your bank will usually send a text or app notification to confirm.

2. For transport passes, you may need to log in to your transport account or scan a barcode provided by the operator.

3. For loyalty or NFC business cards, scan the card’s barcode, QR code, or search for the retailer inside the app.

If you see a verification screen, don’t panic. It’s just security making sure everything checks out.

Once your card is saved, take it for a spin. Try tapping your phone at a shop till, ticket barrier, or coffee shop scanner. To make sure it works:

1. Keep NFC switched on.

2. Hold your phone flat against the reader.

3. Unlock your screen before tapping.

And that’s it. With a quick setup, you’re ready to pay, travel, and scan without digging through your wallet.

Google Wallet can be a bit fussy sometimes, but nine times out of ten it’s a small issue that’s easy to fix. Let’s walk through it together.

1. Check NFC Is On

Sounds obvious, but it catches people out all the time. Head into your settings, look for NFC, and make sure it’s switched on. No NFC, no tap.

2. Unlock Your Phone

The wallet won’t work if your screen is asleep. Always wake and unlock your phone before tapping fingerprint, PIN, or face unlock, whatever you’ve got set up.

3. Try a Different Angle

Card readers can be picky. Hold the back of your phone flat against the terminal, usually near the top half. If nothing happens, move it around slowly until it clicks.

4. Pick the Right App

If you’ve got Samsung Pay or another wallet lurking on your phone, it might be jumping in first. Go into Tap & Pay settings and tell your phone that Google Wallet is the boss.

5. Update, Update, Update

Old apps love to cause problems. Check the Play Store for updates to Google Wallet and Google Play Services. It only takes a minute and often fixes things instantly.

6. Restart or Re-Add Your Card

Sometimes your phone just needs a quick nap. Restart it, then try again. Still no luck? Delete the card from Wallet and add it back. Your bank will re-check everything.

7. Call in Backup

If you’ve tried all this and it’s still not working, the issue might be with your bank or even the shop’s reader. Ring your bank or try tapping somewhere else to see if it’s just that one machine.

Some users try to add generic NFC tags or third-party NFC cards to Google Wallet, but this does not work.

This is because:

• Google Wallet is a closed ecosystem

• Random NFC tags or vendor-based cards cannot be manually added

• Only cards that are officially provisioned by approved issuers are supported

If your NFC card relies on a custom system or third-party vendor, it will need to be used outside of Google Wallet.

Using Google Wallet already puts you a step ahead of old-school plastic. Why? Because every tap uses tokenisation. Instead of flashing your real card number, Wallet swaps in a one-time digital code. Think of it as a mask that hides your details.

Of course, security doesn’t stop there. Wallet only works if your phone is unlocked with a PIN, fingerprint, or face ID. Lose your phone on the bus? No need to panic. You can jump into Find My Device and lock or wipe it before anyone gets near your money.

The bigger threat usually comes from scams. Ever had a text saying, “Click here to verify your card”? That’s a con. Same with emails pretending to be your bank or TfL. Ignore the links. Open the app yourself and check things directly.

One last tip: turn on instant spending alerts in your bank app. A quick ping when you spend is handy, and it helps you spot fraud before it snowballs.

You already know how handy it is to tap your phone to pay. Quick, simple, done. But NFC isn’t stopping there. The future’s going to make your life even easier.

Soon, your phone could be more than a wallet. Imagine using it as your house key, your car key, or even your work pass. Some UK universities are already giving students digital IDs, and it’s a sign of where things are headed.

Worried about safety? Google Wallet already hides your card number with tokenisation, but things are getting even smarter. Think instant fraud alerts, better fingerprint and face ID checks, and systems that block dodgy payments before they happen.

Let’s be honest, carrying a fat wallet full of cards is a pain. The big goal is simple: one app that holds it all. Travel tickets, loyalty cards, bank cards, even your driving licence or NHS details. And because the UK loves contactless, we’ll probably see these features here before many other countries.

Answer: No. Google Wallet only supports cards and passes issued by banks, transport operators, retailers, or organisations that allow digital provisioning. You can add most debit/credit cards, loyalty cards, transport passes, and some student or work IDs, but not random NFC access cards

Answer: Absolutely. You can store several debit, credit, and loyalty cards in Wallet and choose a default one for contactless payments.

Answer: It works on most modern Android phones with NFC and Android 7.0 (Nougat) or higher. If your phone doesn’t support NFC, Wallet won’t work for tap-to-pay.

Answer: Yes, Google Wallet works internationally, anywhere contactless payments are accepted. Just check your bank’s foreign transaction fees before you travel.

Think about how often you reach for your wallet each day. Now imagine doing it all with just your phone. That’s the beauty of Google Wallet. It keeps your bank cards, travel passes, and loyalty points together, so you can tap and go without the fuss. It’s faster, lighter, and a whole lot more secure.

And this is only the beginning. With NFC technology moving quickly, your phone could soon replace even more of what’s in your pocket. If you want to try something smart right now, TapiLink lets you create a digital business card that fits straight into Google Wallet. One tap, and you’ve made a connection.

Join our 50,000+ happy customers

+44 2086 37 2179

Office 22, Wellesley House, 1st Floor, 98-102 Cranbrook Road, Ilford, England, IG1 4NH

Copyright © 2026 TapiLink, made with ❤️ in United Kingdom. TapiLink is a trading name of TAPILINK TECHNOLOGY LIMITED (company number: 16756446), whose registered office is at Office 22, Wellesley House, 1st Floor, 98-102 Cranbrook Road, Ilford, England, IG1 4NH

Subscribe to our newsletter below and get 10% exclusive discount on your first order.